BEIJING (Realist English). As the United States joined Israel in bombing Iran’s nuclear sites over the weekend, China reaffirmed its political backing for Tehran — but stopped short of direct confrontation with Washington or condemnation of Israeli actions.

The Chinese Foreign Ministry condemned the attacks as a “violation of Iran’s sovereignty and territorial integrity,” yet its subsequent messaging has shifted toward calls for restraint and regional stability. “It is in the shared interest of the international community to avoid escalation,” a ministry spokesperson said Monday, while reiterating the importance of stability in the Persian Gulf.

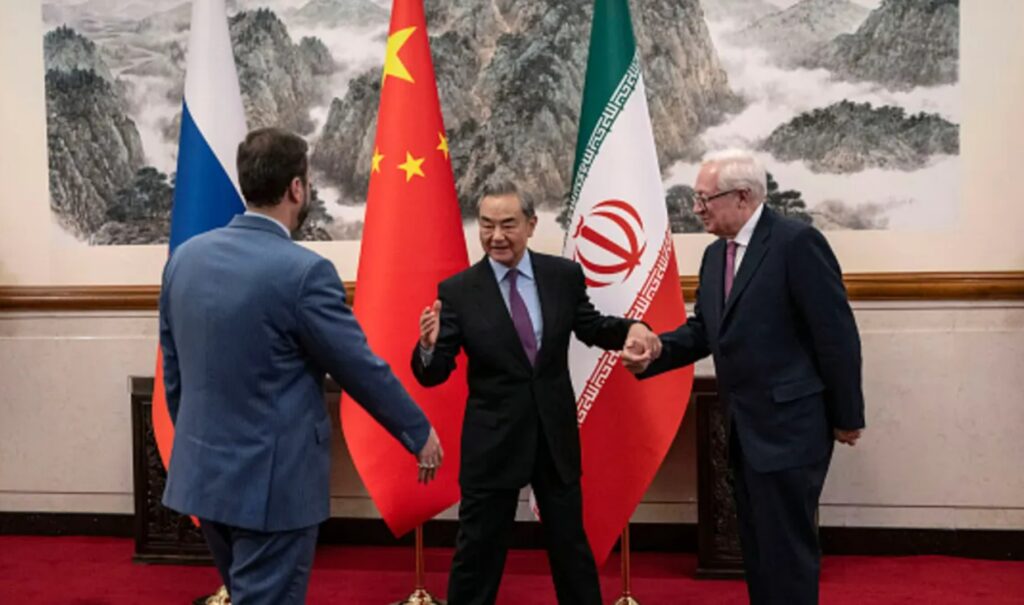

This measured tone underscores Beijing’s complex position: China has grown increasingly close to Iran in recent years, signing a 25-year strategic partnership in 2021 and integrating Tehran into its Belt and Road infrastructure plans. Iran’s large population and oil reserves — along with its strategic location along the Strait of Hormuz — have made it a key partner in Beijing’s long-term vision for a multipolar global order.

But China is also the world’s largest oil importer, and roughly half of its crude passes through the Strait of Hormuz — the narrow waterway now under threat following Iranian warnings and a parliamentary vote backing a potential blockade. The strait handled nearly 20 million barrels of oil per day in 2024, one-fifth of global demand, according to the U.S. Energy Information Administration.

Analysts say China is unlikely to intervene directly. “Beijing has limited leverage over Israel and no appetite for confrontation with the U.S.,” said Neo Wang, lead China economist at Evercore ISI. “Its primary concern is to secure energy supplies without being dragged into the conflict.”

Even so, some observers suggest China may benefit from the crisis. Higher oil prices could strain U.S. and EU economies more than China’s — especially given Beijing’s diversified supply network and sanctions-evading purchases of Iranian oil under alternate labels, notably from Malaysia.

“China will be happy to see a big spike in oil prices if that destabilizes the U.S. and Europe,” said Robin Brooks, senior fellow at the Brookings Institution. Andrew Bishop of Signum Global Advisors added: “Beijing may not mind paying more for oil if Washington suffers greater strategic damage.”

Iran’s parliament has backed a proposal to shut the strait, pending approval from its Supreme National Security Council. The announcement sent oil prices surging in early Monday trading: WTI crude rose over 2% to $75.22, while Brent hit $78.53.

Despite this, Beijing continues to frame itself as a potential mediator. At the UN Security Council, Chinese ambassador Fu Cong criticized both the U.S. and Israel and urged an immediate ceasefire. Yet Beijing has not offered to mediate directly, and Israel remains skeptical of China’s neutrality due to its close ties with Iran and previous contacts with Hamas.

“China is trying to project calm and leadership,” said Shehzad Qazi, managing director of China Beige Book. “But it is also careful not to jeopardize its broader global strategy. Xi Jinping wants to look like a peacemaker without paying the price of real engagement.”