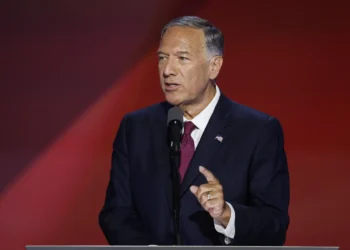

WASHINGTON (Realist English). U.S. Treasury Secretary Scott Bessent has called for a comprehensive review of the Federal Reserve, intensifying the Trump administration’s public campaign against the central bank amid disagreements over monetary policy and management practices.

“We need to examine the entire Federal Reserve institution and whether they have been successful,” Bessent told CNBC on Monday, in comments that reflect growing frustration within the White House over the Fed’s refusal to cut interest rates this year.

His remarks come days after President Donald Trump reportedly asked Republican lawmakers whether he should dismiss Fed Chair Jay Powell, before later clarifying he had no such intention “unless he had to leave for fraud.”

In a follow-up post on X, Bessent stressed that while Fed independence remains a cornerstone of U.S. economic stability, it is now “threatened by persistent mandate creep into areas beyond its core mission.” He said this trend had drawn “justifiable criticism that unnecessarily casts a cloud over the Fed’s valuable independence on monetary policy.”

The White House has also escalated scrutiny of the Fed’s $2.5bn headquarters renovation, with Trump’s budget director Russell Vought accusing the central bank of mismanaging the project, which is now $700mn over budget. The Fed’s inspector general has launched a formal review of the project, which involves overhauling two 1930s-era buildings overlooking the National Mall.

Bessent compared the Fed’s handling of the renovation to systemic failure. “If the Federal Aviation Administration made this many mistakes, we would go back and ask why,” he said.

The Fed published a video tour of the buildings on Monday in an apparent effort to defend the renovation, while Powell has written to lawmakers outlining cost-control measures.

Trump’s criticism of Powell has sharpened in recent weeks. The president has labelled the Fed chair a “stubborn mule” over his reluctance to cut rates further. After slashing interest rates by 100 basis points between September and December, the Fed has held rates steady at 4.25–4.5%, citing persistent inflation risks.

June’s Consumer Price Index showed inflation at 2.7%, its highest since February, fuelling further political pressure. The Fed has struggled to return inflation to its 2% target, amid lingering effects from pandemic-era supply chain disruptions and prior fiscal stimulus.

Trump has publicly urged the Fed to lower rates to 1%, claiming its current stance is increasing government borrowing costs by “hundreds of billions” and undermining economic competitiveness.

Bessent echoed those concerns, accusing the Fed of “fear-mongering over tariffs” and asserting that the U.S. is seeing “great inflation numbers” — despite most economists expecting renewed price pressures in the months ahead.

Some members of the Federal Open Market Committee are reportedly open to rate cuts as early as next week. Among them is Governor Christopher Waller, a contender to succeed Powell, who has argued that signs of a softening labor market justify a 25 basis-point cut.

Powell is due to step down in May 2026, and speculation over his successor is intensifying. Bessent himself was previously viewed as a leading candidate, but Trump recently said he was content with Bessent at Treasury. He also named National Economic Council Chair Kevin Hassett as a top contender for the Fed’s leadership.