SEOUL (Realist English). Samsung Electronics has warned of a steep 56% drop in second-quarter operating profit, missing market expectations and underscoring the dual pressure of U.S. restrictions on AI chip exports to China and delayed qualification of its high-end memory chips by Nvidia.

In a preliminary earnings statement Tuesday, the world’s largest memory chipmaker estimated operating profit at ₩4.6tn ($3.3bn) for April–June — its weakest performance in six quarters and far below the ₩6.3tn consensus forecast from LSEG SmartEstimate. Revenue was broadly flat at ₩74tn.

The company blamed lower earnings in its semiconductor division on inventory valuation losses and the impact of U.S. export controls targeting advanced AI chips bound for China. These curbs have also dented Samsung’s foundry business, which continues to trail TSMC in both yield and customer acquisition.

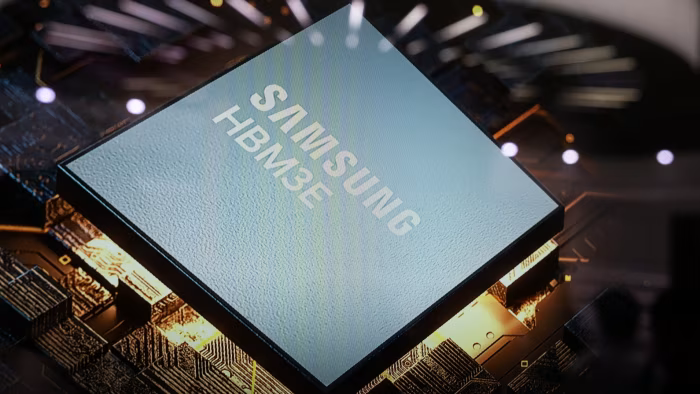

Samsung’s latest HBM3E chips, seen as critical to AI computing, are still undergoing validation by Nvidia. Rival chipmakers SK Hynix and Micron have already secured supply deals and are benefiting from soaring demand. While Samsung has begun shipping to AMD and Broadcom, it remains excluded from Nvidia’s pipeline — a key benchmark in the booming HBM market.

“Sales restrictions and related inventory value adjustments stemming from U.S. export restrictions on advanced AI chips for China, as well as continued low utilisation rates, negatively impacted earnings,” Samsung said in a statement.

According to analysts at DS Investment & Securities, “What counts most is Samsung’s ability to supply Nvidia and broader recovery in chip demand.” They expect a rebound in Q3, but note that Q2 likely marks the bottom.

Samsung shares have underperformed this year, rising only 20% compared to SK Hynix’s 60% rally, reflecting doubts about the company’s ability to seize AI-driven growth. In June, Samsung’s weight in the KOSPI index dropped to its lowest in nine years.

Foundry struggles and China exposure

The company reportedly suffered more than ₩4tn in foundry-related losses in the first half of 2025, failing to secure large-scale clients due to low production yields. The widening performance gap with TSMC remains a concern, even as Samsung pledges to “pursue deals in a do-or-die effort” to revive growth.

Export data earlier this year showed Samsung’s shipments to China surged 54% year-on-year, as Chinese firms scrambled to stockpile AI chips ahead of tighter U.S. export rules. But the longer-term effects of Washington’s sanctions are eroding Samsung’s competitiveness in both semiconductors and consumer goods.

Macro headwinds and smartphone gamble

Beyond chips, the company is facing weaker global TV and appliance sales, partly due to U.S. tariffs and a 7% appreciation of the Korean won, which erodes export price competitiveness.

Samsung is betting on its upcoming foldable smartphone launch in New York to revive momentum. While global foldable shipments grew 12% to 17.2mn units in 2024, Samsung’s market share fell from 54% to 45%, according to analysts.

A full earnings report is expected later this month.