LONDON (Realist English). The Bank of England has lowered its benchmark interest rate by 0.25 percentage points to 4%, the first move to that level in two years, but cautioned that persistent inflation is limiting its capacity to support a sluggish economy.

Governor Andrew Bailey told reporters that while the direction of policy remains downward, there is now “genuine uncertainty” over the pace and scale of future cuts. The Bank’s latest forecasts show inflation rising to 4% in September — double the 2% target — and only returning to target in mid-2027.

The warning is a setback for the government, which has been hoping for looser monetary policy to boost growth, and for households and businesses still feeling the effects of the severe inflation shock that began three years ago. The Bank did, however, slightly upgrade its growth forecast, now predicting GDP will expand 1.25% in 2025, up from 1% projected in May.

Limited political dividend

Chancellor Rachel Reeves welcomed the cut as evidence that fiscal consolidation efforts are working, stressing that borrowing costs are now at their lowest in two years. But market analysts were less optimistic.

“This is cold comfort for the chancellor,” said Laith Khalaf, investment strategy director at AJ Bell. “There’s probably only one interest rate decision before the Budget that could provide a windfall, and markets are pricing in very little chance of any further action in September.”

Khalaf noted that the two-year gilt yield — a key benchmark for the UK’s most common fixed-rate mortgages — rose by 0.05 percentage points after the announcement, signalling that the cut may offer no immediate relief for homeowners.

Divided decision-making

The reduction, consistent with what Bailey called a “gradual and cautious” easing, was far from unanimous: four of the nine members of the Monetary Policy Committee voted to hold rates steady, including Deputy Governor Clare Lombardelli and Chief Economist Huw Pill. This, said Anna Leach of the Institute of Directors, is “a stark reminder that future cuts are not assured.”

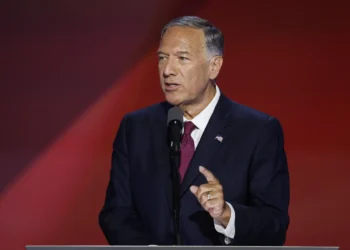

Critics from the opposition benches, including Shadow Chancellor Sir Mel Stride, blamed last year’s Labour budget for sustaining inflationary pressure. “Interest rates should be falling faster, but Labour’s Jobs Tax and reckless borrowing have pushed inflation well above target,” he said.

Food inflation keeps pressure high

One driver of the Bank’s caution is food inflation, which rose 4.5% year-on-year in June, expanding a problem that had mostly been confined to services. Bailey warned that food and energy prices “are salient to consumers and often affect expectations more than other prices,” creating risks of second-round effects in wage and price-setting.

The Monetary Policy Report linked some of the recent price pressures to government policy, including increases in National Insurance contributions, the National Living Wage, and regulated prices for utilities. The British Retail Consortium said new regulations, such as a packaging tax, will add £7 billion to retailer costs this year, further feeding into consumer prices.

Despite the mixed signals, markets still expect two further BoE rate cuts before policy easing pauses — though analysts now see a reduced likelihood of both happening before year-end.