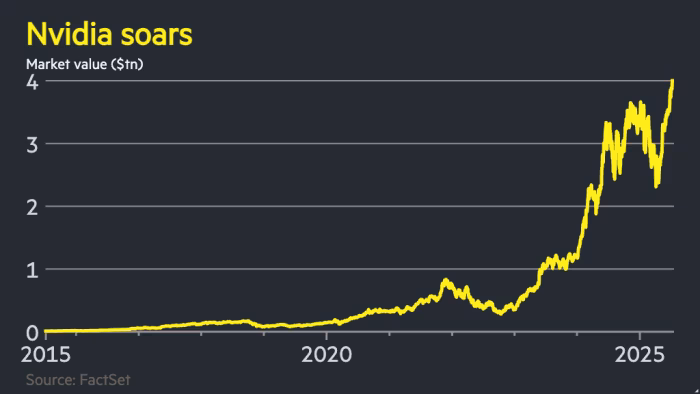

SAN FRANCISCO (Realist English). Nvidia became the first publicly traded company to briefly touch a $4 trillion market capitalisation on Wednesday, underscoring its status as the dominant force in the global AI chip market and the poster child of the ongoing tech rally.

The company’s shares rose as much as 2.8% to an intraday high of $164.42, pushing its valuation just above the $4tn mark before closing at $3.97tn, still 1.8% higher on the day. With this move, Nvidia surpassed Apple’s December 2024 peak of $3.92tn, cementing its lead in the race for tech supremacy.

Driven by surging demand for its advanced processors used in artificial intelligence systems — particularly large language models like ChatGPT — Nvidia’s stock has surged more than 40% since early May. The rally was buoyed by easing trade tensions between the U.S. and China and a series of major chip supply deals struck by the company in the Middle East.

Nvidia’s CEO Jensen Huang has emerged as a central figure in the AI transformation, predicting that artificial intelligence and robotics will generate trillions in future revenue. “Advances in AI are kicking into turbocharge,” Huang said in May, after reporting a 70% increase in quarterly revenue.

Having crossed the $1tn mark in 2023, $2tn in early 2024, and $3tn by mid-2024, Nvidia’s climb has been meteoric. However, it faced temporary headwinds in early 2025 amid concerns over the Trump administration’s tariffs on China and export restrictions affecting Nvidia’s top-tier chips.

Further uncertainty arose when Chinese AI firm DeepSeek unveiled a high-efficiency model claiming to rival top Western systems while using far fewer resources. Despite this, Nvidia’s global position remains robust, bolstered by long-term demand from U.S. tech giants and “sovereign AI” initiatives in Europe and the Gulf.

According to S&P Capital IQ, Nvidia’s revenue is expected to reach nearly $200bn in 2025, up 55% year on year. Forecasts also project net income of $105bn and gross margins exceeding 70%.

The broader confidence in AI’s commercial future is reflected in the explosive growth of firms like OpenAI, whose annual recurring revenue has doubled to $10bn, and Anthropic, which reportedly surpassed $4bn on the same metric.

“The more AI, the better bottom line,” Huang told analysts recently. “The absence of AI is the only thing I worry about.”